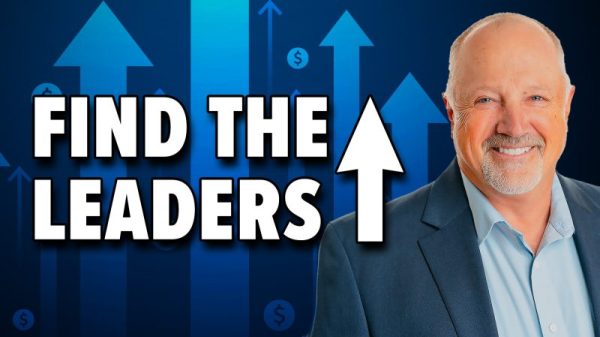

Total housing starts fell to a 1.427 million annual rate in November from a 1.434 million pace in October, a 0.5 percent drop. From a year ago, total starts are down 16.4 percent. Total housing permits also fell in November, posting an 11.2 percent drop to 1.342 million versus 1.512 million in October. Total permits are down 22.4 percent from the November 2021 level.

Starts in the dominant single-family segment posted a rate of 828,000 in November versus 863,000 in October, a drop of 4.1 percent. That is the fifth consecutive month under one million and the slowest pace since May 2020. Excluding the lockdown recession (April and May 2020), November was the slowest month since February 2019. Starts are down 29.7 percent from a year ago (see first chart).

Single-family permits sank 7.1 percent to 781,000 versus 841,000 in October, the sixth consecutive month under one million, and excluding the lockdown recession they are at the slowest pace since November 2016 (see first chart).

Starts of multifamily structures with five or more units increased 4.8 percent to 584,000 and are up 24.5 percent over the past year, while starts for the two- to four-family-unit segment gained 7.1 percent to a 15,000-unit pace versus 14,000 in October. Total multifamily starts were up 4.9 percent to 599,000 in November and show a gain of 23.3 percent from a year ago (see first chart).

Multifamily permits for the 5-or-more group plunged by 17.9 percent to 509,000, while permits for the two-to-four-unit category increased 2.0 percent to 52,000. Total multifamily permits were 561,000, down 16.4 percent for the month and 9.2 percent from a year ago (see first chart).

Meanwhile, the National Association of Home Builders’ Housing Market Index, a measure of homebuilder sentiment, fell again in December, coming in at 31 versus 33 in November. That is the twelfth consecutive drop and the fifth consecutive month below the neutral 50 threshold. The index is down sharply from recent highs of 84 in December 2021 and 90 in November 2020 (see second chart).

Components of the Housing Market Index were mixed in December. The expected single-family sales index rose to 35 from 31 in the prior month, the current single-family sales index was down to 36 from 39 in November, and the traffic of prospective buyers index was unchanged for the month (see second chart).

Input costs are still a concern for builders though lumber prices have declined sharply from recent highs. Lumber recently traded around $375 per 1,000 board feet in mid-December, down from peaks around $1,700 in May 2021 and $1,500 in early March 2022. However, concrete prices continue to rise rapidly, increasing about 24 percent over the last two years (see third chart).

Mortgage rates have pulled back somewhat with the rate on a 30-year fixed rate mortgage coming in at 6.30 percent in mid-December. Rates are up about 360 basis points, more than double the lows in early 2021 and well above the 3.8 percent average for the ten years through December 2021 (see fourth chart).

While the adoption of remote working arrangements for some employees may have been providing support for housing demand, near record-high home prices combined with elevated mortgage rates and cautious consumer attitudes are reducing demand. Pressure on housing demand combined with elevated input costs is sending homebuilder sentiment plunging. The outlook for housing remains unfavorable.