According to a new research report from the IoT analyst firm Berg Insight, there were a total of 4,700 private LTE/5G networks deployed across the world at the end of 2024, excluding proof-of-concept (PoC) projects.

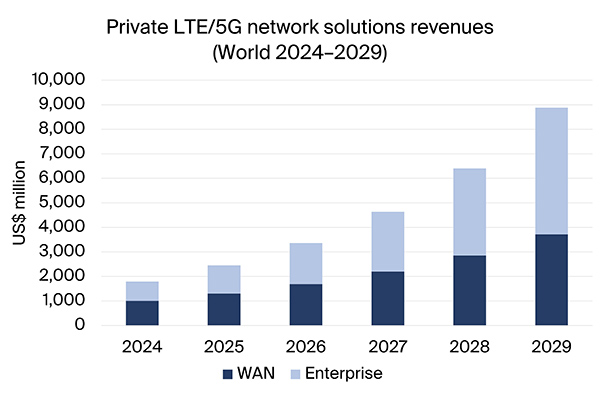

The market value for private LTE/5G network solutions reached an estimated US$ 1.8 billion in 2024.

Berg Insight believes that the market value for private LTE/5G network solutions will grow at a steady pace over the next five years, largely driven by new network deployments. Revenue growth will also be driven by upgrades and expansions of existing networks, as enterprises add new applications and transition from LTE to 5G. Growing at a CAGR of 38 percent, the total market value for private LTE/5G network solutions is forecasted to reach US$ 8.9 billion in 2029.

Melvin Sörum, IoT analyst at Berg Insight, said:

“The increased availability of dedicated spectrum and emergence of new use cases open up a wide range of opportunities for the cellular ecosystem.”

“The shift is fuelling a new wave of investments by established network equipment vendors while also attracting new entrants into the space. The historically supply-driven market is today also increasingly driven by organic demand from end users”, continued Mr. Sörum.

The major RAN vendors (Ericsson, Nokia and Huawei) all play significant roles as end-to-end solution providers and are challenged by a number of smaller RAN equipment providers. The vendors increasingly pursue channel-led sales strategies, and have developed ecosystems of mobile operators, system integrators, VARs and consulting partners to bring solutions to market. Berg Insight ranks Nokia as the largest private LTE/5G network solution vendor with about 800 customers and over 1,500 private network deployments at the end of 2024.

A number of small cell and other RAN equipment providers offer competitive LTE/5G radio products and in some cases complete private network offerings, including Airspan Networks, Askey, Baicells, Benetel, Cablefree, Celona, Firecell, GXC, JMA Wireless, Mavenir, Samsung Networks, Sercomm, Star Solutions and ZTE. Important specialised core network software vendors include Cisco, Cumucore, Druid Software, Expeto, Highway 9, HPE and Microsoft. In total, RAN and EPC/5GC offerings for private networks are available from over 60 vendors.

According to Berg Insight, the introduction of as-a-service business models is currently one of the strongest trends, along with the increased virtualization of network functions, implementation of the O-RAN concept in radio products and launch of neutral host network solutions. Other key trends identified by the research firm that could significantly impact private LTE/5G network adoption include regulatory changes and emerging technologies such as Wi-Fi 7 and network slicing, which may serve as potential substitutes for private cellular networks.

The post The private LTE/5G market reached 4,700 network deployments and a market value of US$ 1.8 billion in 2024 appeared first on IoT Business News.