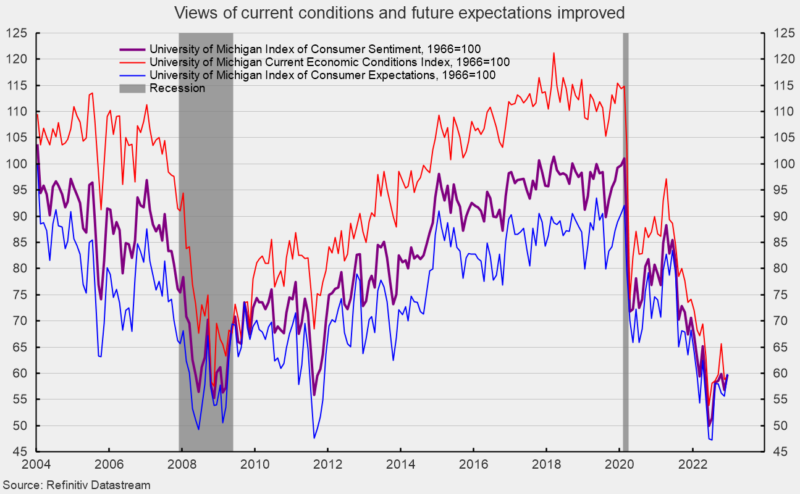

The final December results from the University of Michigan Surveys of Consumers show overall consumer sentiment improved for the month but remains near historically low levels (see first chart). The composite consumer sentiment index increased to 59.7 in December, up from 56.8 in November. The index hit a record low of 50.0 in June and is down from 101.0 in February 2020 at the onset of the lockdown recession. The increase in December totaled 2.9 points or 5.1 percent. The level of the composite index remains consistent with prior recessions.

The current-economic-conditions index rose to 59.4 versus 58.8 in November (see first chart). That is a 0.6-point or 1.0 percent increase for the month. This component is just 5.6 points above the June low of 53.8 and remains consistent with prior recessions.

The second component — consumer expectations, one of the AIER leading indicators — gained 4.3 points, or 7.7 percent for the month, to 59.9. This component index is 12.6 points above the July 2022 low of 47.3 but 32.2 points or 35.0 percent below the February 2020 level. This index remains consistent with prior recession levels (see first chart).

According to the report, “Consumer sentiment confirmed the preliminary reading earlier this month, rising 5% above November. Sentiment remains relatively downbeat at 15% below a year ago, but consumers’ extremely negative attitudes have softened this month on the basis of easing pressures from inflation.” The report adds, “One-year business conditions surged 25%, and the long-term outlook improved a more modest but still sizable 9%. Still, both measures are well below 2021 readings.” The report further notes, “Assessments of personal finances, both current and future, are essentially unchanged from November.”

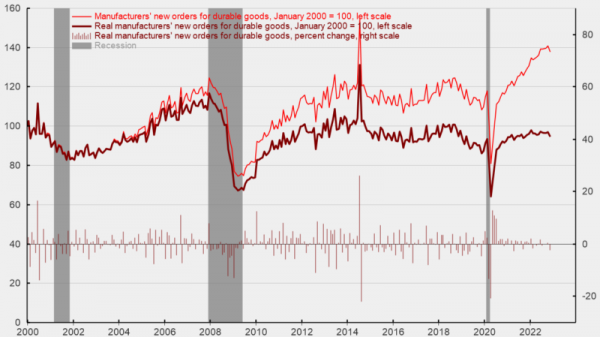

The one-year inflation expectations fell again in December, declining for the sixth time in eight months to 4.4 percent. The result is significantly below the back-to-back readings of 5.4 percent in March and April, and the lowest level since June 2021 (see second chart).

The five-year inflation expectations fell in December, coming in at 2.9 percent. That result is well within the 25-year range of 2.2 percent to 3.4 percent (see second chart). The report states, “Year-ahead inflation expectations improved considerably but remained elevated, falling from 4.9% in November to 4.4% in December, the lowest reading in 18 months but still well above two years ago. Declines in short-run inflation expectations were visible across the distribution of age, income, education, as well as political party identification. At 2.9%, long run inflation expectations have stayed within the narrow, albeit elevated, 2.9-3.1% range for 16 of the last 17 months.” Furthermore, “While the sizable decline in short-run inflation expectations may be welcome news, consumers continued to exhibit substantial uncertainty over the future path of prices.”

Pessimistic consumer attitudes reflect a significant list of concerns, including inflation, rising interest rates, and falling asset prices. Overall, economic risks remain elevated due to the impact of inflation, an aggressive Fed tightening cycle, and the continued fallout from the Russian invasion of Ukraine. However, the decline in inflation expectations is a welcome development. Still, the economic outlook remains highly uncertain. Caution is warranted.